By Dozek Group Real Estate Limited

Introduction:

Buying a home in Nigeria is often considered a major milestone, yet for many, the thought of applying for a mortgage can feel overwhelming. Between paperwork, eligibility requirements, and the uncertainty of approval, countless prospective homeowners hesitate to take the leap.

But here’s the truth: with the right information and preparation, qualifying for a mortgage in Nigeria doesn’t have to be stressful. In fact, it can be a structured, straightforward process one that leads you closer to owning your dream home without unnecessary hurdles.

Below, we’ll break down 10 proven ways to qualify for a mortgage in Nigeria, ensuring you approach the journey with confidence, clarity, and control.

1.Maintain a Strong and Steady Income

The first thing lenders look for is whether you have a reliable income stream. Nigerian banks and mortgage institutions want assurance that you can repay your loan without difficulty. CEOs, business owners, or professionals with documented income sources have a significant advantage. Even if you run your own company, keeping proper financial records, audited statements, and bank flows is essential. A stable income reassures lenders of your repayment capacity, making it one of the most powerful ways to qualify stress-free.

2.Keep Your Credit History Clean

Though Nigeria’s credit reporting system is still developing compared to other countries, lenders now rely on the Credit Bureau to evaluate borrowers. A history of unpaid loans, bounced cheques, or defaulted obligations will harm your chances. On the other hand, evidence of timely repayment whether on personal loans, car financing, or even utility bills builds trust with lenders. Keeping your credit record clean not only positions you for mortgage approval but can also secure better interest rates.

3. Save for a Strong Down Payment

One of the fastest ways to gain lender confidence is by providing a substantial down payment. Most Nigerian mortgage providers require between 20–30% of the property’s value upfront, depending on the type of property. The higher your deposit, the less risk for the lender, and the more favorable your terms.

Beyond making approval easier, a larger down payment also reduces your monthly repayment burden, giving you financial breathing room.

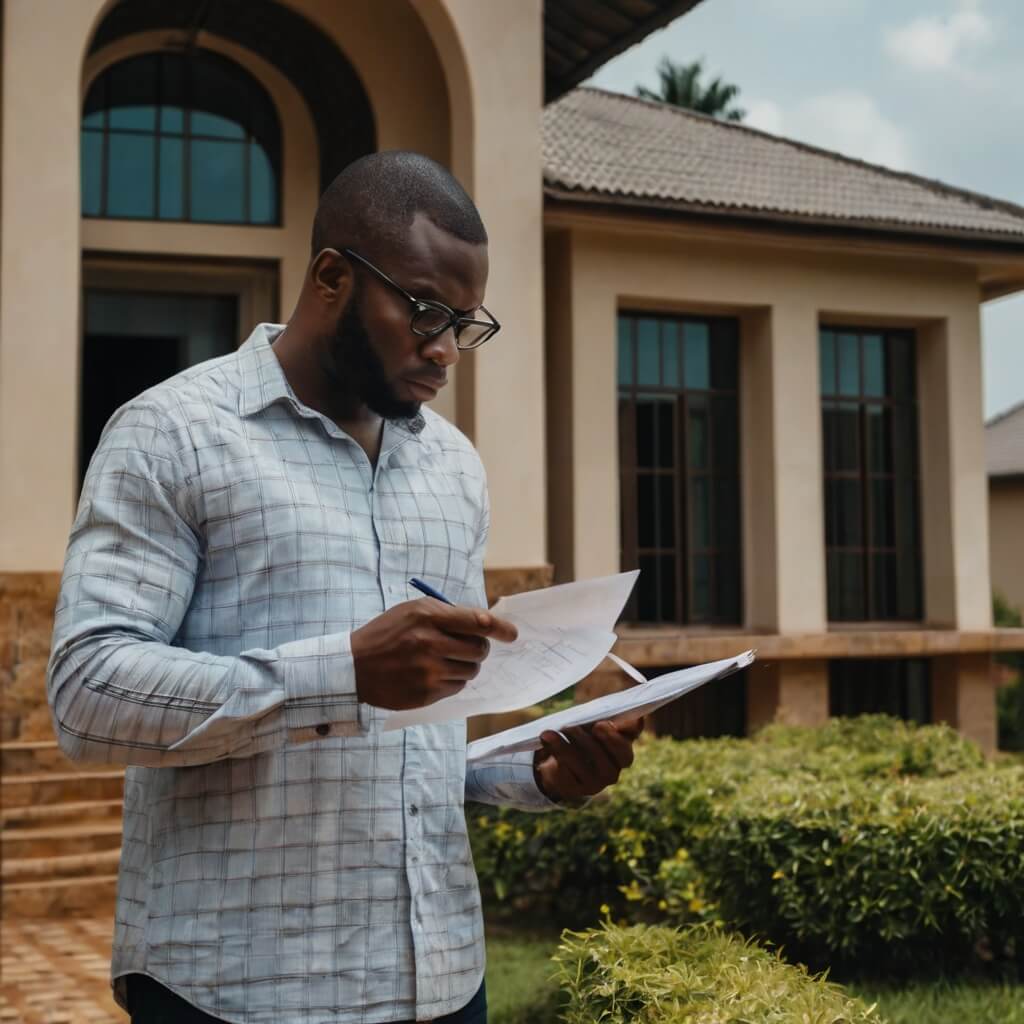

4.Organize Your Documentation Early

A common cause of stress during mortgage applications is scrambling for paperwork at the last minute. Lenders typically request proof of income, tax clearance certificates, bank statements, employment letters (for salaried workers), or audited accounts (for business owners).

Having these documents organized and updated before you even apply will dramatically reduce delays. Preparation is power and it signals professionalism to lenders.

5. Choose the Right Mortgage Provider

Not all mortgage lenders in Nigeria operate under the same terms. Some cater more to salaried workers, while others are structured for high-net-worth individuals and entrepreneurs. Research options like the Federal Mortgage Bank of Nigeria (FMBN), commercial banks, or private mortgage institutions.

Select the one whose products align with your income type, lifestyle, and repayment goals. The right match not only boosts your approval chances but also reduces unnecessary obstacles.

6.Keep Your Debt-to-Income Ratio Low

Lenders want to see that you’re not overburdened with other financial obligations. If more than 35–40% of your monthly income is already going into debt repayment, banks will hesitate to add a mortgage on top.

Before applying, aim to clear high-interest debts, restructure outstanding loans, or negotiate longer repayment plans. A healthy debt-to-income ratio is one of the most persuasive signals you can send to a lender.

7.Build a Relationship with Your Bank

Banks are far more likely to approve mortgages for clients they know and trust. Maintaining a steady relationship with your bank through savings accounts, business banking, or long-standing transactions works in your favor.

Over time, your financial history becomes more visible to them, making it easier for the bank to assess and approve your application. Think of it as building goodwill that pays off when you need financing.

8.Demonstrate Employment or Business Stability

Lenders prefer applicants who have demonstrated consistency in their work or business. If you’ve been with the same employer for several years or you run a business with documented growth, your profile is stronger.

Constant job-hopping or unsteady income flows raise red flags. Show proof of professional or business stability it’s a sign that you’re dependable and capable of long-term repayment.

9.Understand the Property You’re Financing

Lenders are not just lending to you they’re lending against the property as collateral. If the property you’re buying lacks proper land titles, has disputes, or is outside approved urban areas, banks may refuse to finance it.

Working with reputable developers like Dozek Group ensures that your property is properly documented, secure, and bankable. This dramatically increases your chances of mortgage approval while protecting your investment

10.Work with a Real Estate Expert

Navigating the mortgage process alone can be intimidating. A professional real estate company like Dozek Group not only guides you to the right properties but also connects you with trusted financial institutions, helps organize documentation, and advises on the best financing structures.

With expert guidance, you cut through the confusion and focus on what matters most securing your dream home without stress.

✅ Conclusion

Qualifying for a mortgage in Nigeria doesn’t have to be a headache. By preparing ahead, maintaining financial discipline, and working with the right partners, you can position yourself for easy approval. Whether you’re a first-time buyer or a high-net-worth individual expanding your real estate portfolio, the key is strategy and preparation.

At Dozek Group Real Estate Limited, we specialize in helping clients like you not only find the perfect home but also navigate the financing process with confidence and ease.

📢 Call to Action

💼 Ready to move from saving to building wealth?

👉 Contact Dozek Group today to explore premium properties and tailored mortgage solutions that make the path to ownership simple and successful.

📞 Contact us today to secure your next great investment.